FBR Pakistan 2025-26: Tax Guide, Registration & Iris Portal

FBR Pakistan 2025-26: Tax Guide, Registration & Iris Portal

Federal Board of Revenue (FBR) Pakistan 2025-26: Tax Compliance Guide

Introduction

Pakistan's Federal Board of Revenue (FBR) governs all taxation systems, from income tax to customs duties. This updated 2025-26 guide explores new Iris portal features, registration processes, and compliance requirements under recent budget changes. Essential reading for businesses and individuals navigating Pakistan's evolving tax landscape.

Understanding FBR's Core Functions

The Federal Board of Revenue:

Manages national tax collection and policy

Operates the Iris digital portal for filings

Publishes Active Taxpayer Lists (ATL) annually

Implements federal budget directives

Transition: Therefore, compliance begins with understanding these pillars.

2025-26 Critical Updates

Enhanced Digital Requirements

POS integration mandatory for PKR 10M+ turnover businesses

Biometric verification for STRN registration

E-invoicing for all VAT-registered entities

Step-by-Step Registration Processes

New NTN Application

Visit Iris Portal → Select "New Registration"

Upload business incorporation documents

Receive NTN certificate within 72 hours

Internal link: Detailed NTN application walkthrough

Filing Annual Returns

Select correct form (114 for salaried, 115 for business)

Validate pre-filled data from employers/banks

Submit before September 30, 2025 deadline

Essential Compliance Tools

| Tool | Purpose | Access |

|---|---|---|

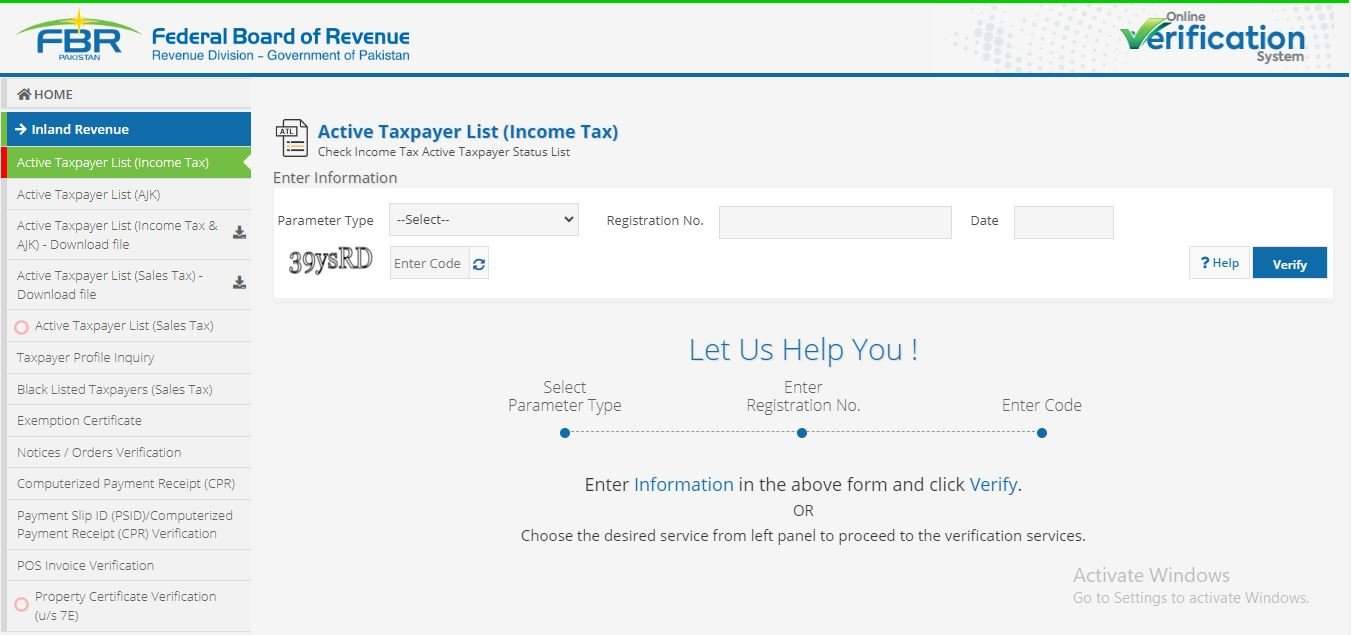

| ATL Verifier | Confirm active taxpayer status | Iris portal → "ATL Search" |

| Withholding Calculator | Deduction rates by sector | FBR Resource Center |

| Payment Portal | Secure tax dues settlement | Iris → "Payments" |

Avoiding Penalties

Critical deadlines:

September 30, 2025: NTN/STRN registration for new businesses

Monthly: Sales tax returns (STRN holders)

Quarterly: ATL status verification

Otherwise, penalties include:

PKR 50,000 late filing fine

H2: Support Resources

☎️ Helpline: 051-111-772-772 (8AM-10PM daily)

🔍 Status Tracking: Iris Portal Support

Internal link: Resolve common portal errors